Google Adsense Tax Info (Ireland)

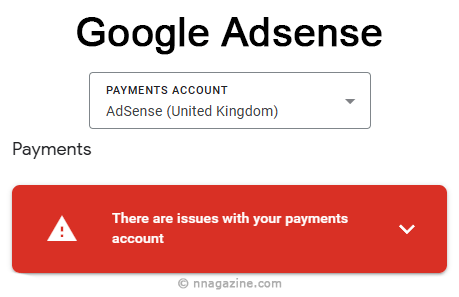

(Issues with your payments account)

I’m based in the UK and tried to submit my tax info for Google Adsense…

https://www.google.com/adsense Payments > Settings > Manage tax info.

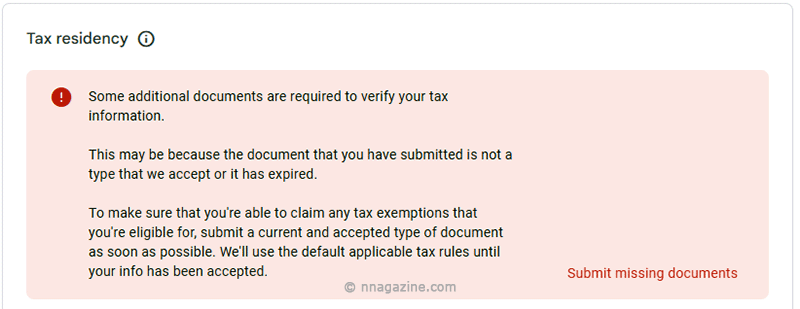

Google Adsense needed a document to verify my tax information. So I submitted the first page of my Self Assessment Tax Calculation, as proof of my UK residency and that I pay UK tax. The first page of this document contained my:

- Name and address.

- Unique Taxpayer Reference.

- And was dated (recent).

I thought this would be sufficient… But it wasn’t?

Issues With Your Payments Account

I then decided I needed to get a Certificate of Residence (CoR), sometimes called a Tax residency certificates (TRC). This is mentioned in the Adsense documentation.

In the UK, you can apply for a Certificate of Residence online, by post or by emailing a form, (there is another link within this overview page, that allows you to sign in under ‘How to Apply’). You will need a Government Gateway Account.

When you sign in and start to fill in the form, this is where the fun starts. Most of the form is straight forward, (if you fill in a self assessment tax form). But then you get to the Section:

Article of Double Taxation Agreement

Which article of the country’s Double Taxation Agreement covers the income in this request?

My first thought was what an earth is this? So I Googled it. Not much help found, as most wording appears to be gobbledygook! I presume legal techno language!!

After a bit more searching, I found this under ‘Proof of UK tax residency for Google Ireland‘…

If you scroll down through the comments, there are some tips on what to put in the online application…

Hope this helps… ![]()